Present value of annual payments calculator

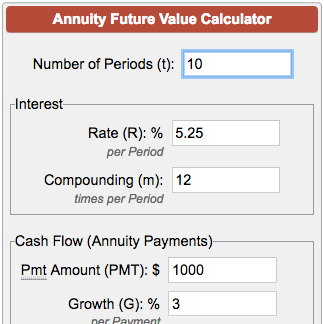

An example would be an annuity that has a 12 annual rate and payments are made monthly. Present value calculator in Excel.

Annuity Present Value Pv Formula And Calculator Excel Template

Use the Bond Present Value Calculator to compute the present value of a bond.

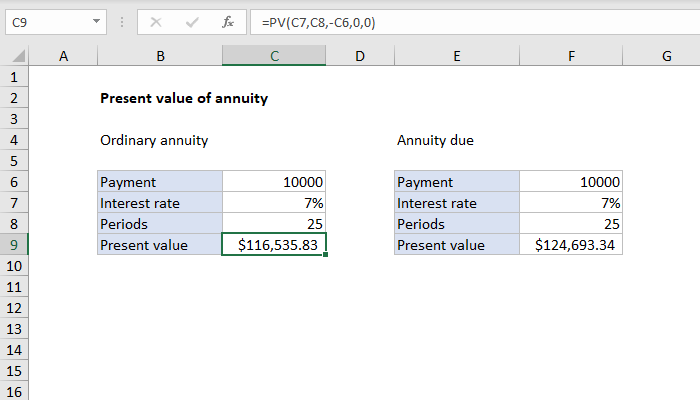

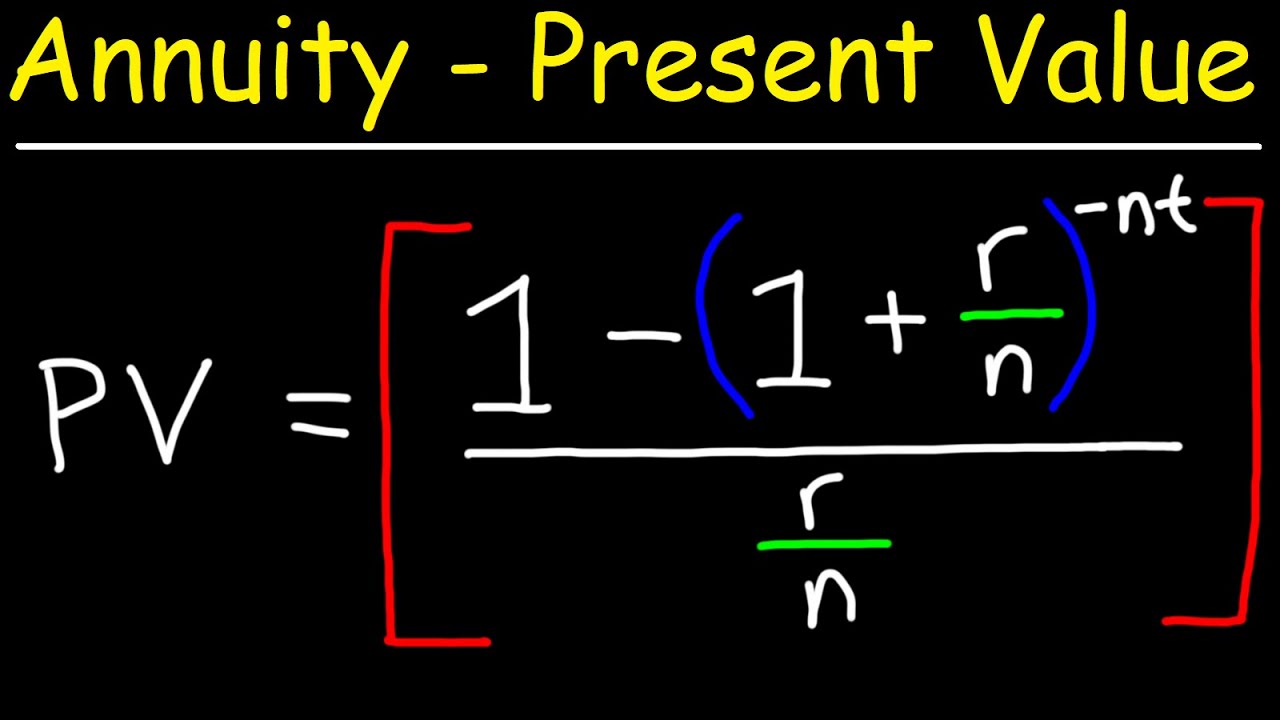

. The NPV function can be used to calculate the present value of uneven cash flows spaced evenly in time. The present value of an annuity is the current value of a set of cash flows in the future given a specified rate of return or discount rate. If youd like to know how to estimate compound interest see the article on.

The PV function can only be used when cash flows are constant and dont change. Present value PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return. Enter 1 for annual payments which is once per year Enter 4 for quarterly payments Enter 12 for monthly payments.

If the payment is per month then the rate needs to be per month and similarly the rate would need to be the annual rate if the payment is annual. The future value of a dollar is simply what the dollar or any amount of money will be worth if it earns interest for a specific time. A versatile tool allowing for period additions or withdrawals cash inflows and outflows aka.

Present Value Of An Annuity. Now in order to understand which of either deal is better ie. Can the net harness a bunch of volunteers to help bring books in the public domain to life through podcasting.

Calculate the present value investment for a future value lump sum return based on a constant interest rate per period and compounding. 5000 if the present value of Rs. Using the Bond Price Calculator Inputs to the Bond Value Tool.

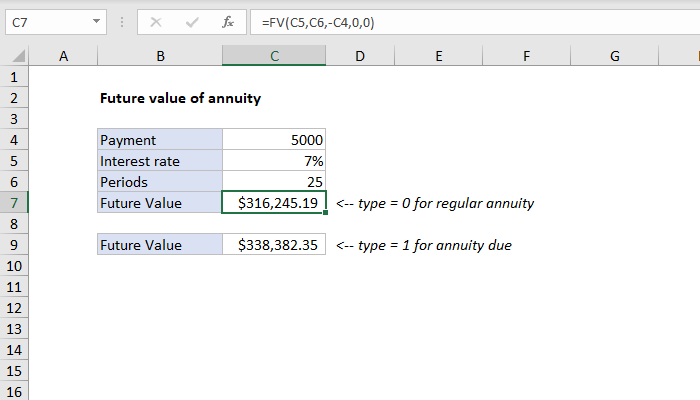

For Aadhya the present value is INR 10000. So when determining the lease liability and ROU asset the future lease cash flows must undergo the present value calculation. Future value with paymentsComputes the future value of annuity by default but other options are available.

Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. When putting deposits to a saving account paying home mortgage and the like you usually make the same payments at regular intervals eg. It may be seen as an implication of the later-developed concept of time preference.

There you have it a way to calculate the present value of lease payments using Excel. The most common uses for the Present Value of Annuity Calculator include calculating the cash value of a court settlement retirement funding needs or loan payments. The currently calculated monthly payment.

This sum equals the present value of a 10-year lease with annual payments of 1000 5 escalations and a rate inherent in the lease of 6 or 9586. In reverse this is the amount the bond pays per year divided by the par value. The future cash flows of.

You need to calculate the present value of 150. If she invests this for 8 per annum for a year the future value of her investment is. 5500 on the current interest rate and then compare it with Rs.

5500 is higher than Rs. The currently calculated annual payment. The present value calculator uses the following to find the present value PV of a future sum plus interest minus cash flow payments.

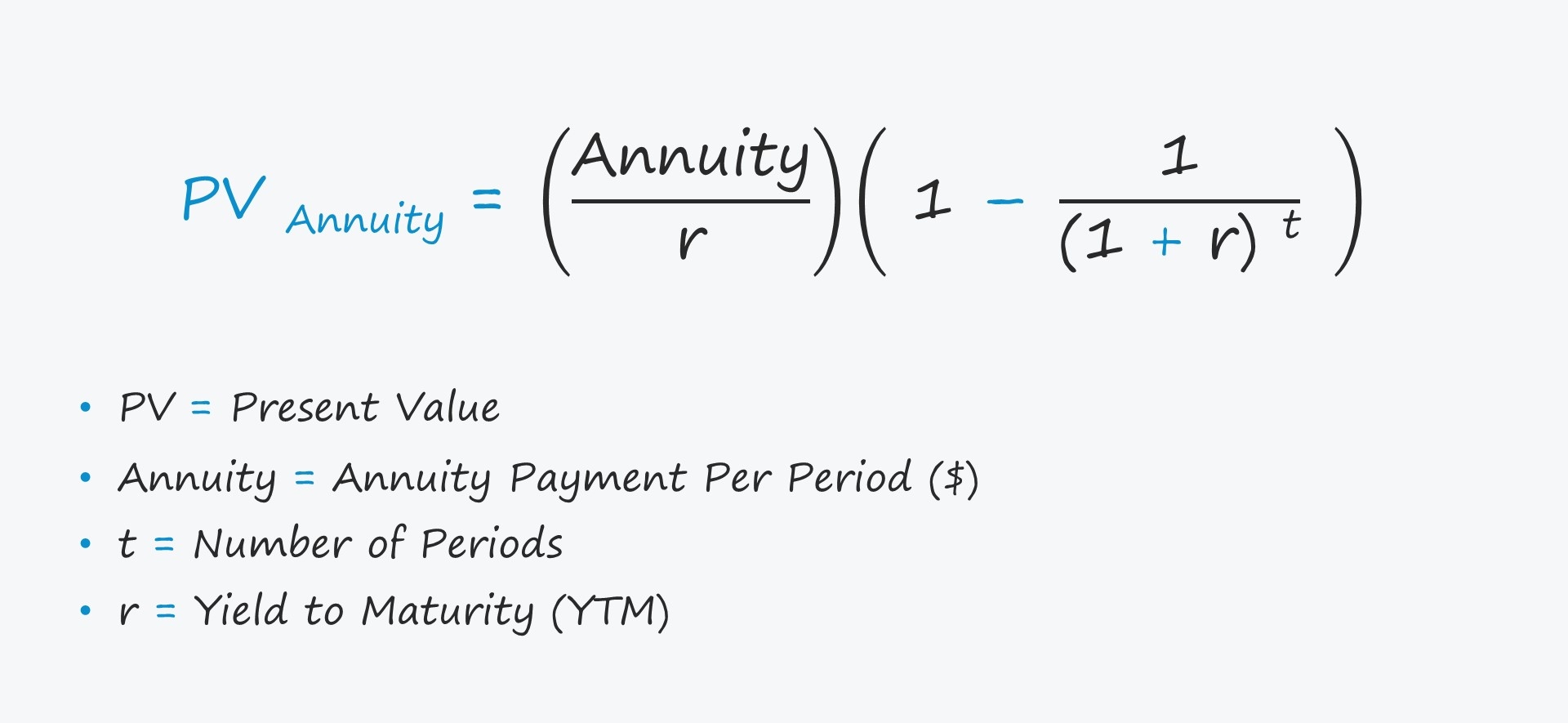

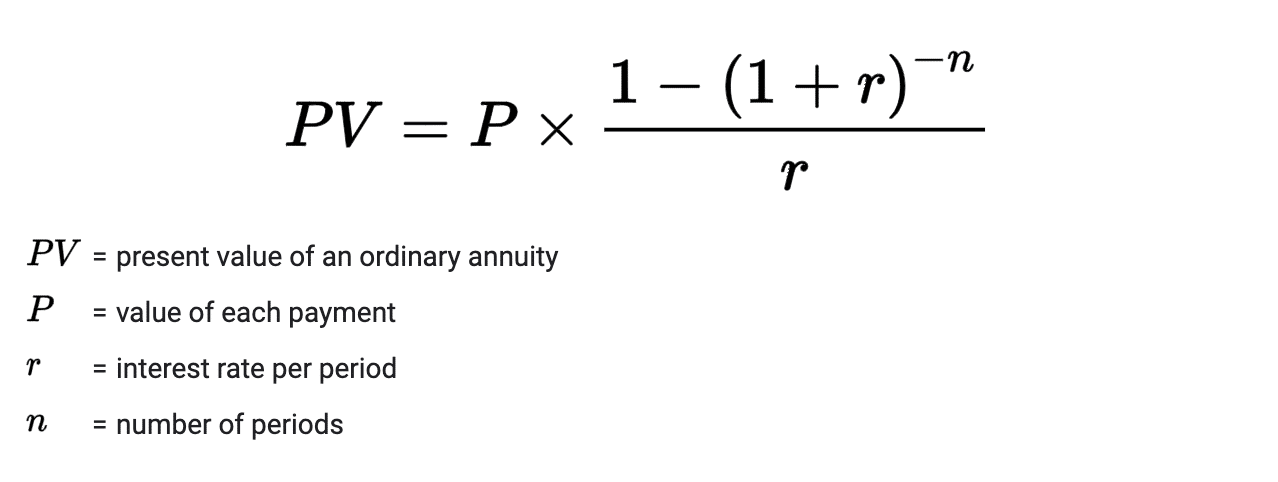

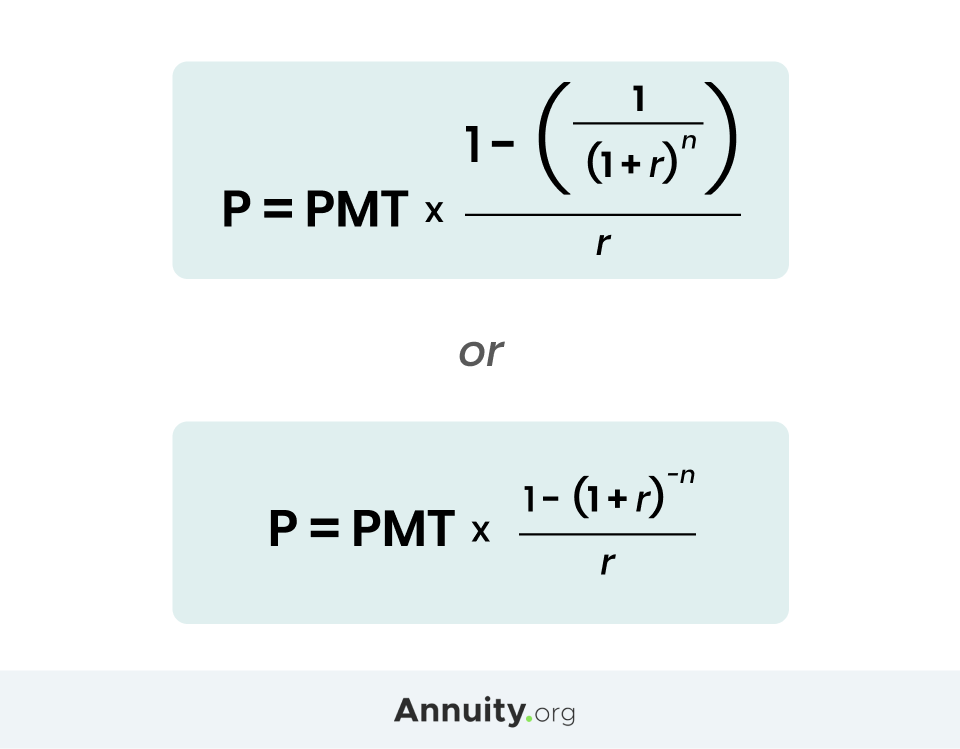

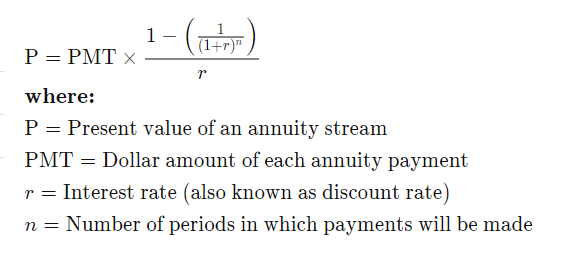

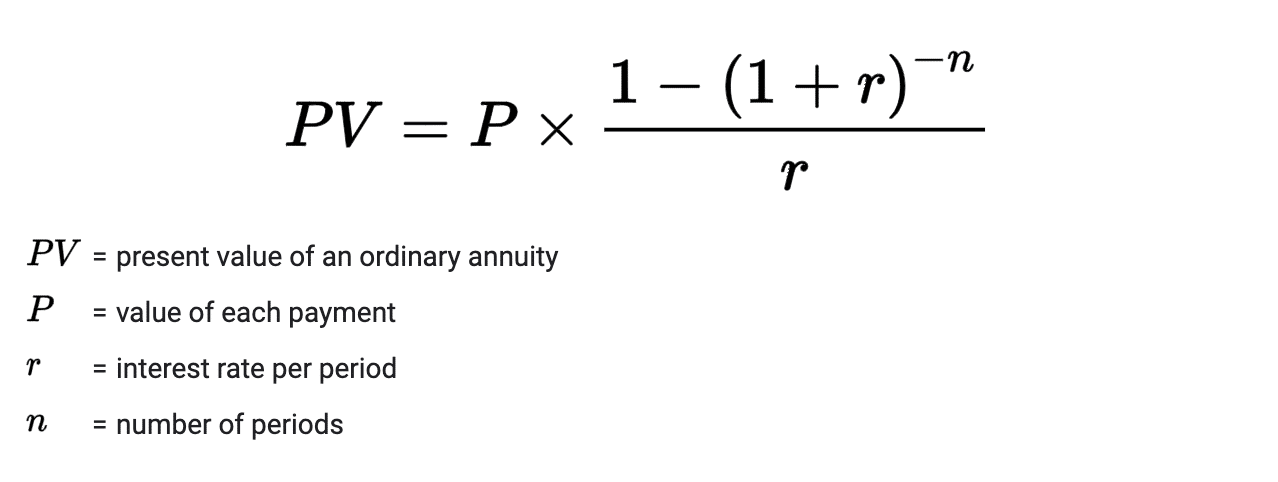

If 100 is deposited in a savings account that pays 5 interest annually with interest paid at the end of the year then after the 1 st year 5 of interest will. Use the perpetuity calculator below to solve the formula. The formula for the present value can be derived by using the following steps.

The lottery offered Aadhya to choose between two payments. Present Value of Interest Payments Payment Value 1 - Market Rate 100 -Number Payments. The monthly rate of 1 would need to be used in the formula.

Is the annual nominal interest rate or stated rate per period in percent. Present Value - PV. Such series of payments either inflow or outflow made at equal intervals is called an annuity.

Whether Company Z should take Rs. Use this FV calculator to easily calculate the future value FV of an investment of any kind. Thus this present value of an annuity calculator calculates todays value of a future cash flow.

In addition you can use the calculator to compute the monthly and annual payments to save a certain amount of money future value for retirement education etc. The present value is the total amount that a future amount of money is worth right now. Market Rate 100 Number Payments.

The time value of money is among the factors considered when weighing the opportunity costs of spending rather than saving or. Present Value of a perpetuity is used to determine the present value of a stream of equal payments that do not end. However if instead of being paid in 10 annual installments you.

Annual Coupon Rate is the yield of the bond as of its issue date. Choose if payments occur at the end of each payment period ordinary annuity in arrears 0. The present value calculation has not changed from ASC 840 to ASC 842.

Bond Face ValuePar Value - Par or face value is the amount a bondholder will get back when a bond matures. We can also calculate Present Value from Future Value. Future cash flows are discounted at the discount.

Apart from the various areas of finance that present value analysis is used the formula is also used as a component of other financial formulas. The annuity may be either an ordinary annuity or an annuity due see below. See also our Annuity Mortgage and Loan Future Value.

This is a special instance of a present value calculation where payments 0. Any implied annual rate which could be inflation or the rate of return if the money was invested money not spent today could be expected to lose. Examplediscounted present value or DPV.

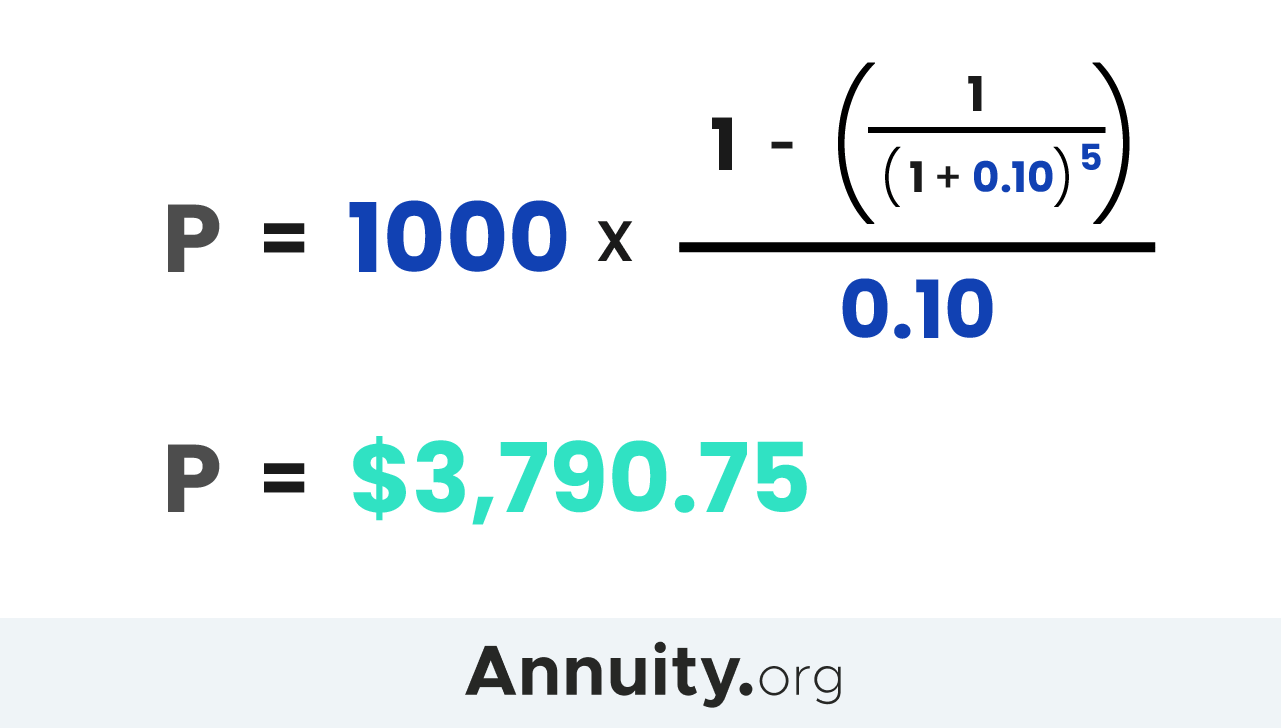

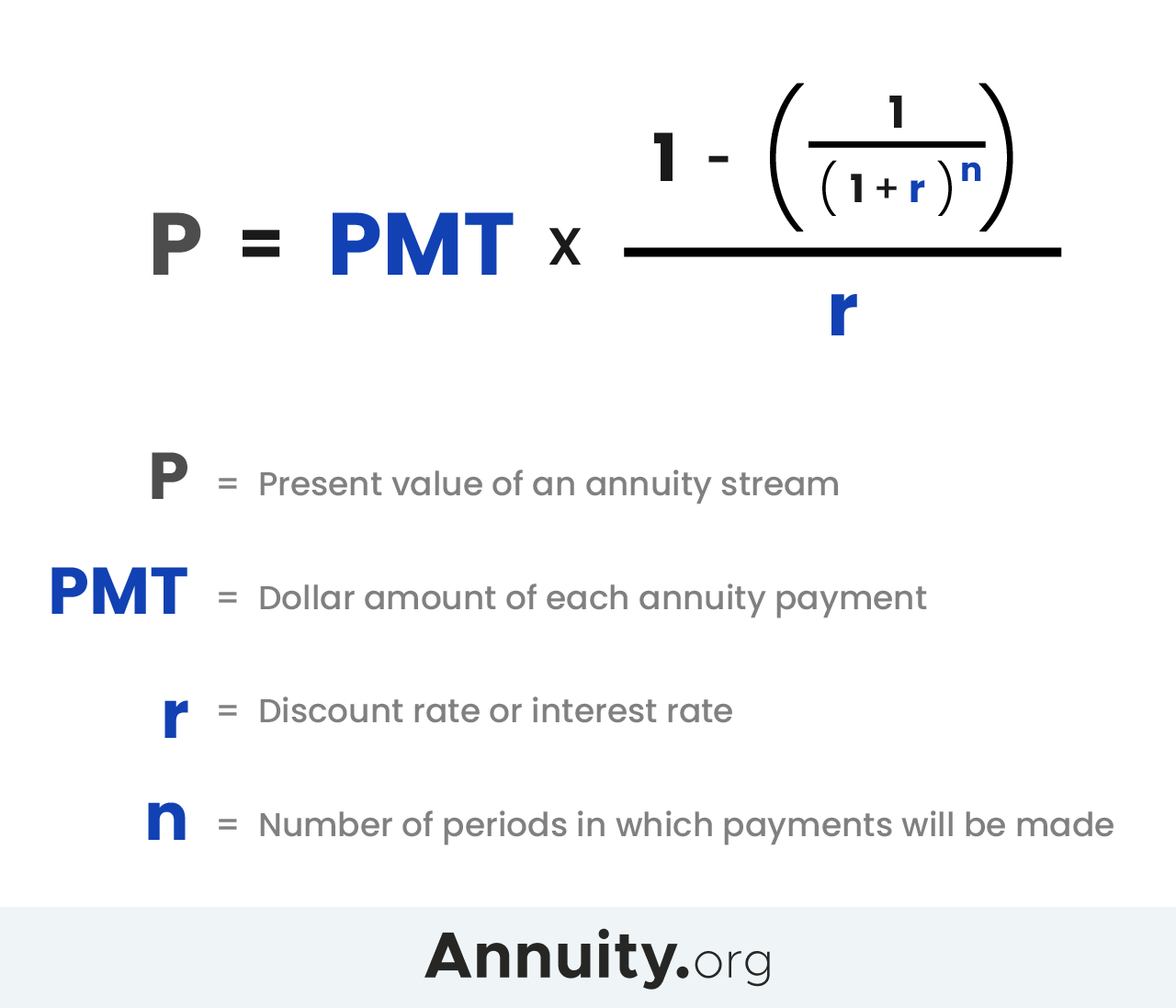

Present value of annuity. The future value FV of a dollar is considered first because the formula is a little simpler. In fact the present value is typically less than the future value.

Next decide the discounting rate. For example a court settlement might entitle the recipient to 2000 per month for 30 years but the receiving party may be uncomfortable getting paid over time and request a. If an annuity is scheduled for 10 annual payments of 10000 each the sum of the payments is 100000.

Present Value Therefore the present-day value of Johns lottery winning is. R R100 the interest rate in decimal. See How Finance Works for the compound interest formula or the advanced formula with annual additions as well as a calculator for periodic and continuous compounding.

Future Value FV. How Each Standard Explains Present Value. 5000 then it is better for Company Z to take money after two years otherwise take.

5000 today or Rs. Both the PV function and the NPV function calculate present value but there are differences in the way they operate. Firstly figure out the future cash flow which is denoted by CF.

Face Value is the value of the bond at maturity. The time value of money is the widely accepted conjecture that there is greater benefit to receiving a sum of money now rather than an identical sum later. LibriVox is a hope an experiment and a question.

The PV function has a type argument to handle. Present Value 96154 92456 88900 85480. Weekly monthly quarterly or yearly.

Use this calculator to find the present value of annuities due ordinary regular annuities growing annuities and perpetuities. 5500 after two years we need to calculate a present value of Rs. The present value of a perpetuity formula can also be used to determine the interest rate charged and the size of the regular payment.

Present Value Of Annuity Formula Calculate Pv Of An Annuity

Pv Of Perpetuity Formula With Calculator

What Is An Annuity Table And How Do You Use One

Future Value Of Annuity Calculator

Excel Formula Present Value Of Annuity Exceljet

How To Calculate Present Value Of An Annuity

Present Value Of Annuity Calculation Knime Analytics Platform Knime Community Forum

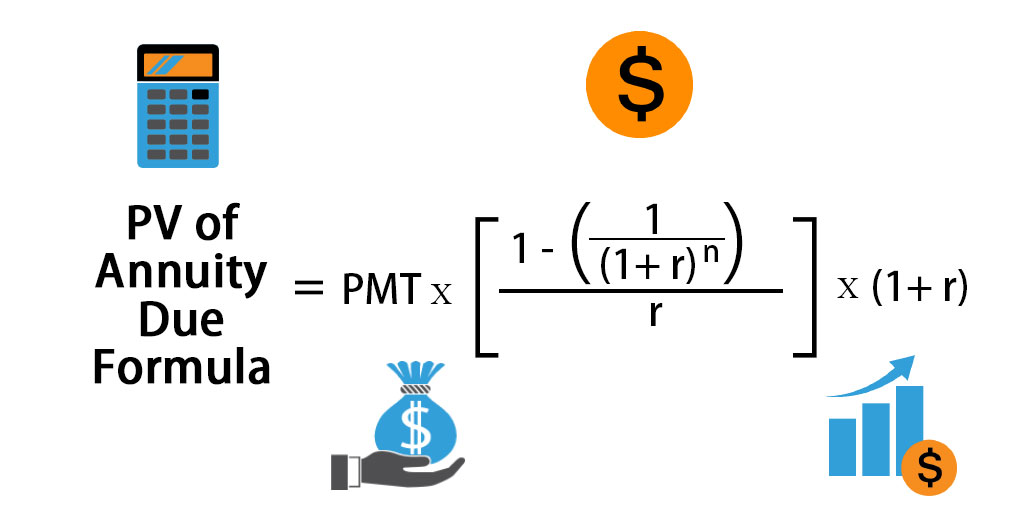

How To Measure Your Annuity Due

Present Value Of An Annuity How To Calculate Examples

Present Value Of Annuity Formula With Calculator

Excel Formula Future Value Of Annuity Exceljet

Present Value Pv Of An Annuity Example Problem Youtube

How To Calculate The Present Value Of An Annuity Youtube

Present Value Of An Annuity How To Calculate Examples

Present Value Of Annuity Due Formula Calculator With Excel Template

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Calculating Present And Future Value Of Annuities

Pv Annuity Calculator Discount 53 Off Www Ingeniovirtual Com